Martin Armstrong

I began writing what I thought would be a report. Toward the final chapters in Adam Smith’s Wealth of Nations, he wrote about Public Debt asking why anyone considered it to be quality since all governments defaulted on their debts and never paid them off. I assumed the list wasn’t that long, since everyone knew about the defaults of Spain,

France, and England. The more I began to investigate since Smith merely made that statement with no reference to such defaults, the more I was left in a state of devastating shock. When it comes to research, those that know me understand that I leave no stone unturned. I allow the research to carry me along a journey of exploration. I never PRESUME anything and try to LEARN myself to round out my knowledge.

It is almost finished. I am publishing for the first time the Table of Contents. There just seems to be such profound conviction that everyone will flee to gold, gold will save the world, and there is always an alternative for capital to flee. The emails from the Goldbugs just refuse to understand that there is also DEFLATION. Here is the latest:

“You assume two things here, sadly both are wrong. You assume firstly that the US dollar will always be more stable than (for example) the yuan, the Brazilian Real, the Euro. A dangerous and flawed assumption, one perhaps made by a dying Roman empire, and the British Empire too. Nope, always something new out there to step in. Your other assumption, even more flawed, and currently being proven wrong as I type the world over, is that capital will flee to another fiat. Nope, much of it will flee to (or try to flee to) solid physical gold. Because that is what the world has always done. ‘Giant’ money is already there, the US’s strategic enemies are already there, and adding gold reserves every month, rather than soaking up the ever-growing flow of US dollar debts.”

It is just astonishing. I am interested in discovering what makes the world tick. I am not like Marx who tried to dictate to the world this is how I say you must function to fit some preconceived idea. If the dollar is the CORE RESERVE CURRENCY and the reserves around the world are really in US government bonds, just how does anyone assume you can flee to the yuan, Brazil or better still to the Euro that will create their desperate vision of hyperinflation? There is not enough assets in those countries combined to absorb the cash in US bonds. Only about 18% of the German DAX freely floats since the rest is tied up in cross-holdings. Only the dollar can absorb that amount of cash. Brazil? Come on! China has its own bubble. Buildings are vacant in ghost cities and the quality of new construction has been extremely poor. Like all emerging markets, it is over-extended.

When municipals went bankrupt in the 1930s like the city of Detroit, capital was able to distinguish a muni from the feds and not all munis defaulted. However, had the feds defaulted, then they take down ALL the munis at once. There is a HUGE difference between a fringe and a core economy. The assumption is other countries’ reserves will somehow survive a US hyperinflation? Brazil and China combined could NOT absorb all the cash from the US and Europe. Their economies are not that big. To arbitrarily say “giant” money is already in gold – where? How? When? Why is it still fleeing to the dollar sending 10-year rates to record lows?

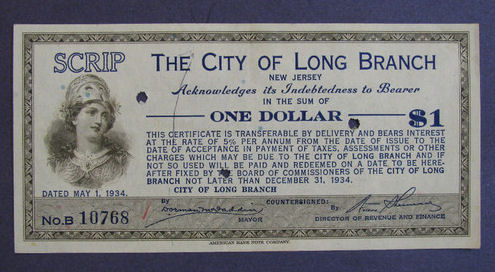

Another best kept secret of the Great Depression I have included in the upcoming book on the Great Depression & the Sovereign Debt Crisis of 1931, is the fact that there were vast amounts of private currency being issued at that time because of hoarding and bank failures. There was NO money to even circulate. Of course the socialists did not want to write about that as well because it reflected the collapse in government’s ability to manage the economy.

It seems axiomatic that whenever a government fails to provide an adequate supply of currency or coin to maintain commercial trade, the people will step in and provide their own fiat to fill the vacuum. This is something the Goldbugs fail to grasp. Money will become whatever the people accept as the medium of exchange and when government fails to provide that medium, they create their own fiat system. Thus, the use of “scrip” during the 1930’s was not a new idea in the United States. During other earlier financial crises such as the Panic of 1837, the Civil War years, and the Panics of 1873, 1893 and especially 1907, many different kinds of private emergency fiat currency had been issued.

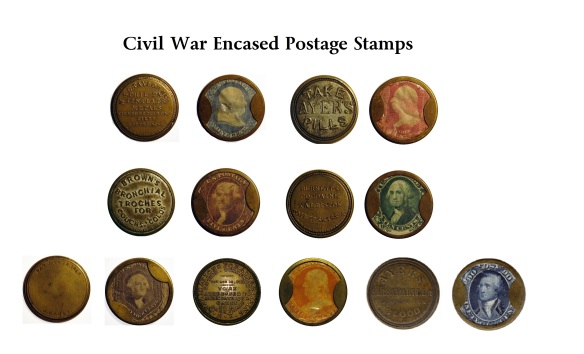

During

the American Civil War, they needed metals for guns and ammunition.

Nickel was replace with silver being more valuable during war. The

shortage of coin was so pervasive, private companies issued Postage

Currency as illustrated here advertising on the reverse.

During

the American Civil War, they needed metals for guns and ammunition.

Nickel was replace with silver being more valuable during war. The

shortage of coin was so pervasive, private companies issued Postage

Currency as illustrated here advertising on the reverse.

During the worst periods of the Great Depression, many communities were temporarily deprived of normal monetary supplies and functions because of bank failures, hoarding of money, and inability to collect taxes. People simply had no money to spend. To counteract this situation, various forms emergency currency or “scrip” were issued. The first of these appeared as early as 1931, though it was not until a year later that it was being issued in any appreciable quantities. By February of 1933, according to a Bureau of Foreign and Domestic Affairs estimate, there were over 400 communities using some form of emergency fiat currency – and this was before the official “bank holiday” and the resulting flood of scrip across the country. Gold was hoarded – not used as money.

Clearly, people will create money if the state fails to provide it. Roman coins exist in quantity today solely due to the very same human trends that appear in every crisis – hoarding. This reduces the VELOCITY of money creating DEFLATION yet INFLATION as costs rise..

I have stated numerous times that the purchasing power of the Roman denarius collapsed to the point it purchased 1/50th of its previous worth. The German Hyperinflation was 170 marks to the dollar at the beginning to 87 trillion. To compare this with the fall of Rome with money dropping to 1/50th of its former value, that is only 170 to 8500. Rome did not go the way of hyperinflation. It was the CORE economy and it collapse at 170 to 8500 level not 170 to 87 trillion.

Sorry, but you can die in a desert from extreme heat or freeze to death in Antarctica from extreme cold. To survive, we need a temperate climate to live within. DEFLATION or INFLATION can kill an economy. Empires do not die by HYPERINFLATION – that is reserved for the fringe. When an empire dies, it historically has ALWAYS been by DEFLATION/STAGFLATION. How? Real wealth is driven from the ABOVEGROUND economy into the UNDERGROUND economy where it is hoarded and tucked away. This is why we find hoards of Roman coins. This reduces the VELOCITY of money and commerce collapses. This is ALWAYS AND WITHOUT EXCEPTION how empires die. This is why there was “scrip” issued in the United States during the Great Depression. The VELOCITY of money came to a halt in different regions.

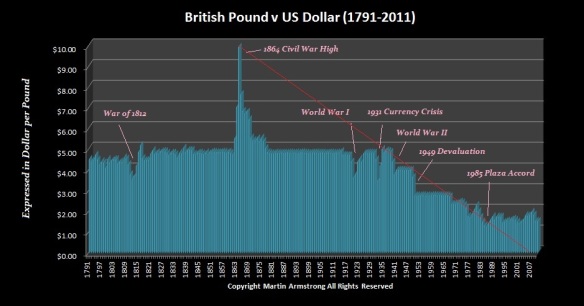

The British Empire did not die of HYPERINFLATION. The pound collapsed in value. It did not inflate into oblivion. The British Empire simply rolled over and died. The decline of the sterling silver penny of England was no different a path than the decline and fall of Rome. The United States will follow the same path and that means there is a risk that it will break apart into regional sections ONLY AFTER the dollar is hit very hard following Europe and then Japan.

This is fairly simple. All the hyperinflationists can point to is Germany and Zimbabwe. They can offer not a single historical example of how HYPERINFLATION ever destroyed any empire. I have no vested interest in HYPERINFLATION or DEFLATION. I simply do the research and let the evidence speak for itself. This is just not a personal opinion issue in the least. Both will lead to the same end result – the death of an empire. Why must there be an argument over such nonsense? It is DEAD from fiscal mismanagement!

The question how do empires die is absolutely critical to surviving the Sovereign Debt Crisis. You can buy gold and listen to this nonsense about hyperinflation and $50,000 an ounce while everything else is worth shit. You will be right insofar as in the end the empire will die. However, you may not make it to the finish line with this myopic view of the world.

The very word “suburbium” is what the Romans called it. People left the cities fleeing taxes. The population of Rome itself just collapsed. No city ever matched that size again until the Victorian era in London. This is how empires die. The cost of government always rises oppressing the private sector since the public sector is like a drunk – it just consumes and has the hand out claiming he needs money to eat instead of drink. The people either leave or revolt in their struggle to cope with the persistent unpredictable demands of government that historically NEVER lives within its means.

The Goldbugs are not even in the right church forget the right pew. It has never been this battle against what is money. Nor has it concerned a “gold standard” that has not survived the folly of man even once because everything fluctuates in value and cannot be fixed. Sorry. It has always been the perpetual battle against the spendthrift ways of those in power who squanders the resources of the people and assumes authority to extort from them whatever they desire at the moment.

It matters not what period we look at, the end result NEVER changes. Most of the leading German cities freed themselves in the second half of the 13th century from all forms of subordination to territorial princes, yet they were not as autonomous as the independence republics enjoyed by the Italians. This movement towards autonomy was facilitated by various princes’ urgent financial needs. The great episcopal cities of Cologne, Augsburg and Mainz became free cities. In the struggle for autonomy, possession of financial resources was a decisive factor in victory. Impoverishment, nonetheless, facilitated the return of the lords because of the failure to manage the fiscal spending of the city.

The city of Mainz had gained its rights to be self-governing in 1118. It had become a free city in 1244. Cities where the patriciate refused to pay direct taxes willingly turned to borrowing even on a permanent basis. Mainz experienced extremely heavy indebtedness, which in turn led to a heavy tax burden on the townspeople. Consequently, there emerged a succession of urban tax revolts led by the guilds in a number of city states such as those in Nuremberg during 1348, followed by 1364, 1370 and 1396 in Cologne, 1355 and 1364-1365 in Frankfurt, 1370 in Augsburg, and 1383 in Lubeck. From about 1332 onwards, the trade guilds (unions) became deeply involved in managing the government Mainz that stemmed the tide of any economic crisis until 1411.

The popularity of municipal borrowing was closely related to the sale of annuities. Life annuities were sought after by people as a form of insurance providing a sort of pension for their old age. Lenders did not turn over their money to their own town; there was a market for public loans and, in order to reduce risk, people made loans to several cities. In 1408, the Burgermeister of Rothenburg obtained loans from 120 different localities, something which clearly distinguishes borrowing from direct taxation, though in this case what we are witnessing is a mutuum or a voluntary loan, and not a prestitum (which was a forced loan). Short-term borrowing was gradually replaced by the sale of annuities. Life annuities were also favored by governments, as they presented possibilities of profit should bond-holders die. This type of non-redeemable bond entailed a high rate of interest of 10 per cent. Certain cities preferred to replace them with perpetual bonds which meant lower interest rates of between 3 and 5 per cent and which, being redeemable, could easily become a form of short-term credit.

While the fiscal mismanagement of Cologne and Nuremberg demonstrate how the great German cities’ need for credit expanded regularly, we find great examples of direct and indirect taxation intermixed with floating debt composed of life annuities yielding 10% interest and the confiscation of Jewish property in 1385 that was cheered only because it enabled city states to abandon direct taxation. This was not unlike the targeting of the “rich” today whereas at this point in time the distinction was made based upon religion that justified seizing the wealth of the rich.

Nevertheless, it was the city of Mainz that provides a colorful an example of the political decline caused by excessive debt and bad management of public finances that we face today. Financial difficulties had led to the trade guilds being involved in the government of the city from 1332 onwards. A major political conflict was thus avoided until 1411 when the payment of debt annuities accounted for 48% of total expenditure.

In 1411, there was a popular uprising that now forbade the sale of any more debt without the consent of the trade guilds. Yet, the financial conditions continued to worsen. By 1436-1437, about 75% of the total city expenditure was now being consumed by interest. Interest rates began to rise as there were subtle fears that Mainz might not be able to pay its debts. The interest rates climbed as the city tried to find buyers for its debt. The interest rates jumped from 3% to 5% during the 1430s.

Johann Gutenberg (c. 1398-1468), the German printer, is supposed to have been born c.1398-1399 at Mainz of well-to-do parents, his father being Friele zum Gensfleisch and his mother Elsgen Wyrich (or, from her birthplace, zu Gutenberg, the name he adopted). He is assumed to be mentioned under the name of “Henchen” in a copy of a document of 1420, and again in a document of c. 1427-1428, but it is not stated where he then resided. In 1420 the citizens of Mainz drove the patricians out of the city in a tax revolt, and as Gutenberg’s name appears about ten years later at Strasburg, the family probably took refuge there.

A new city government emerged established by the tax revolt forbade the sale of any more annuities without the consent of the trade guilds. Despite this tax rebellion between the trade guilds and the patricians, the city’s financial situation continued to decline as it effective sent the “rich” fleeing. Clearly, with the “rich” gone, the city was unable to revive its economy having effectively destroyed Adam Smith’s Invisible Hand. This led to the expelled families being recalled to Mainz, for we now see that Gutenberg did not avail himself of the privilege since he is described in the Act of Reconciliation (dated March 28) as “not being in Mainz.” The return of the patricians may have been predicated upon their buying debt of the city since on January 16, 1430, Gutenberg’s mother arranged with the city of Mainz to purchase an annuity belonging to her son. This appears to be the reason for the recall of the expelled rich when the city cannot revive its economy without them.

We next hear of Gutenberg at Strasburg, where he was associated with the goldsmiths guild there between 1434 and 1444. In 1434 he seized and imprisoned the town clerk of Mainz for a debt due by the corporation of that city. However, he released him at the urgent representation of the mayor and counselors of Strasburg, and he relinquished at the same time all claims to the money (310 Rhenish guilders = about 2400 mark silver). In 1437 Gutenberg was sued before the ecclesiastical court by Emmeline zu IserneThure for breach of promise of marriage, but the case was settled by his making the woman his wife. In 1442 he borrowed £80 from the Chapter of Saint Thomas in Strasbourg that he appears never paid back. He seems to have returned to Mainz around 1444, since we do know in 1448 on October 6th, he borrowed 150 gulden. It was two years later when he borrowed 800 gulden from Johann Fust, a lawyer and wealthy merchant banker. In 1452, he borrowed another 800 gulden from Fust making him a partner. This was an incredible amount of money equal to about 10-years wages.

Finally, in 1436-1437, 75% of the total expenditure of Mainz went to creditors, whose interest payments continued to increase crowding out all economic growth. The interest expenditures were draining the economic fortunes of Mainz and now there was an ever increasing difficulty to find new subscribers to its loans. This escalated causing interest rates to rise. During the 1430s, Mainz offered 5% for the perpetual annuities instead of the previous 3% or 4%. The total national debt of Mainz reached 373,184 gulden. It was in 1448, when the city of Mainz could find no buyer of its debt and was unable to raise 21,000 gulden that it declared itself bankrupt. Since 60% of the debt was invested outside Mainz, the city was placed under Imperial ban, excommunicated by the Pope whereas today 40% of all interest paid by the United States goes overseas. Taxes were raised and the rich deserted the city further ensuring the collapse of its productive forces. With the richest bourgeois gone and the city deeply impoverished, the fortunes of the city turned negative.

Adolph II (or III) of Nassau-Wiesbaden-Idstein (German: Adolf II. von Nassau-Wisebaden-Idstein) (c. 1423 – 6 September 1475), was Archbishop of Mainz from 1461 until 1475. He was a son of Count Adolph II of Nassau-Wiesbaden-Idstein. On June 18, 1459 he was defeated in the election to the Archbishopric of Mainz by Theodoric of Isenburg-Büdingen who was never confirmed by the Pope. In 1461 he went to Nuremberg for Imperial and Papal reform, and its recommendations earned him the wrath of both the Emperor Frederick III and Pope Pius II. It was then in 1461 that Pope Pius II declared Adolph the Archbishop of Mainz following the confrontational reforms of Theodoric.

Since the city of Mainz and its and cathedral chapter remained loyal to Theodoric, Adolph declared war. The devastating Mainzer Feud continued for a year until on October 28th, 1462 Adolph captured the city. Some 400 citizens were executed, and another 400 fled abroad. Adolph also revoked Mainz’s privileges and the status as an Imperial City. Mainz was sacked by Archbishop Adolph von Nassau, and Johann Gutenberg was exiled from Mainz and he moved Eltville where he may have initiated and supervised a new printing press belonging to the brothers Bechtermünze. Gutenberg died in 1468 and was buried in the Franciscan church at Mainz, his contributions largely unknown. This church and the cemetery were later destroyed, and Gutenberg’s grave is lost.

During economic crisis, money is hoarded. People curtail their spending to survive. Grover Cleveland addressed the Congress is a Special Session where he criticized his own party stating:

“At times like the present, when the evils of unsound finance threaten us, the speculator may anticipate a harvest gathered from the misfortune of others, the capitalist may protect himself by hoarding or may even find profit in the fluctuations of values; but the wage earner – the first to be injured by a depreciated currency – is practically defenseless. He relies for work upon the ventures of confident and contented capital. This failing him, his condition is without alleviation, for he can neither prey on the misfortunes of others nor hoard his labour.”

So what should we expect? As the economy collapses, people will hoard and spend less. This is the check and balance against HYPERINFLATION. Furthermore, there are huge political ramifications involving a CORE RESERVE CURRENCY compared to Zimbabwe or Germany in the 1920s that cannot be ignored. The dollar cannot move into HYPERINFLATION for it is the reserve currency that would bring everything down with it. Empires do not die in that manner. The value of the dollar will certainly decline against assets, but it will not move into HYPERINFLATION. World War III would breakout before that. Capital cannot simply flee to yuan, Brazil or any other place, because if the reserve currency goes, so does everything else. China’s reserves would vanish overnight. The notion of HYPERINFLATION is nice – just not practical. Empires collapse they have never expired by HYPERINFLATION. When an empire dies that is the major reserve of all nations, we must be concerned about a complete meltdown and the breakup of the nation long-before HYPERINFLATION would even be possible. Gold’s role will be as the alternative UNDERGROUND economy and a store of wealth in time of political crisis. Remember – institutions will always be vulnerable to seizure. So never leave your gold in a bank that could be seized. You are defeating the very purpose of buying gold in such circumstances.

No comments:

Post a Comment